While many people take for granted everything from swiping a credit card to contributing to a savings account, millions of people around the world are not connected to banking institutions.

Take Africa, for example. As of 2014, 66% of the adult population in sub-Saharan Africa remained “unbanked.” Although traditional banks exist in this area, unaffordable banking fees, mistrust of financial institutions, and a lack of understanding of internet banking options keep Africans outside of the banking system.

Smart feature phones are increasing financial inclusion by creating opportunities for the unbanked.

What does it mean to be unbanked?

The term “unbanked” describes anyone who does not have a bank account or any services tied to a banking institution, such as a debit or credit card. The unbanked rely on cash payments and are often unable to plan for their financial future.

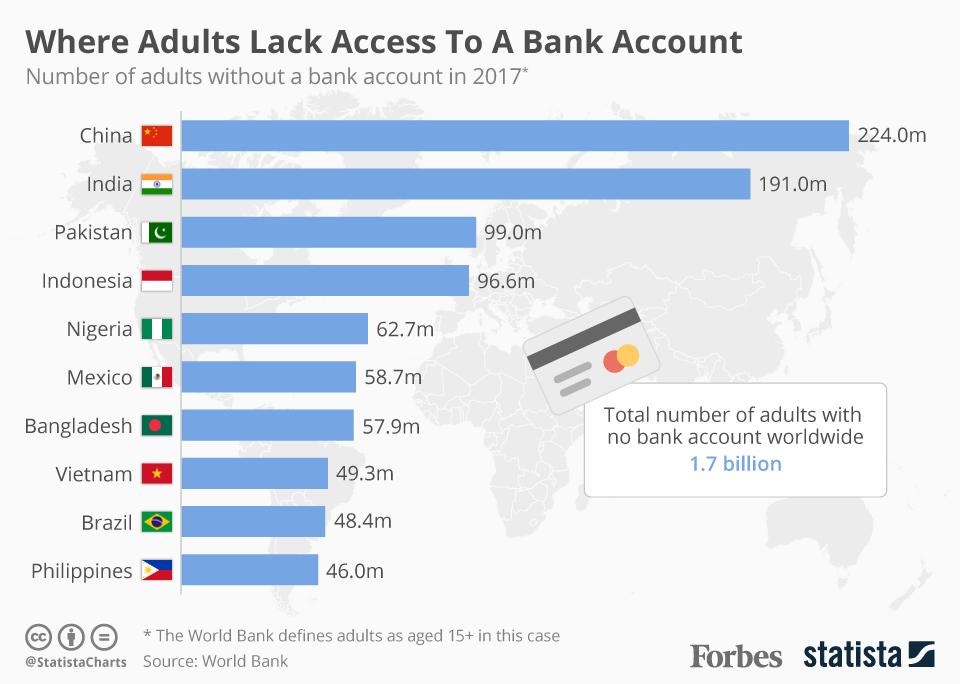

As of June 2018, over 1.7 billion adults worldwide did not have access to a bank account. Unbanked populations are particularly large in Low-to-Middle Income Countries (LMICs):

What causes someone to remain unbanked?

While there are many reasons that someone might be unbanked, it often boils down to a few main causes.

1. Lack of knowledge or access

Opening a bank account is a bureaucratic process requiring paperwork that may be difficult to understand, particularly in areas with low literacy rates. Plus, banks require proof of a stable income to open an account, but any people in emerging markets do not have formal jobs or stable salaries.

Access to physical bank locations is a common issue as well. Residents of rural communities are forced to travel long distances while carrying large amounts of cash just to reach a bank.

2. Cost

Traveling to reach faraway banks is not just inconvenient but also costly. In addition to the price of using public transportation, people must also absorb the losses caused by missing hours or even days of work due to the time spent in transit.

Even if banks are physically accessible, the cost of keeping a bank account open can be enough to put them out of reach of many locals. Unfortunately, banks in developing countries are known for charging predatory fees for everything from printing a bank statement to completing a basic transaction.

3. Mistrust

Financial institutions are sometimes assumed guilty of embezzlement or fraud, which creates a lack of trust in the entire system. As such, many people feel that their money is more secure under a mattress in their own homes rather than in a bank.

Online banking is also clouded with mistrust. The fear of having a bank account hacked or losing money during an online transaction makes people wary of using online banking services.

Smart feature phones make mobile money accessible

Mobile money, aka mobile financial services (MFS), allows users to send, receive, and store money without needing a bank account. Funds are stored in a secure electronic account attached to a mobile phone number. However, because mobile money requires an internet connection, customers need more than a basic cell phone to take advantage of it.

Enter the smart feature phone, which offers mobile internet connectivity at a fraction of the cost of a touchscreen smartphone. And starting in 2020, KaiOS-powered smart feature phones will allow users to receive money, contribute to their personal savings, and even manage business finances — all with mobile money services.

Currently, Africa is the number one adopter of mobile money, followed by South Asia and Latin America. We have several regional partnerships in Africa that make smart feature phones available for as little as $20 and are working to bring similarly priced devices to additional markets.

Lives around the world are already being positively affected by mobile money.

MiCash leverages financial literacy education to gain mobile money customers in Papua New Guinea

Only 15-20% of Papua New Guinea’s population has access to financial services. In 2012, Nationwide Microbank set out to address the unbanked by launching MiCash.

MiCash leverages financial literacy education to gain new mobile money customers. In an effort to better serve residents of villages and rural towns, Nationwide invests in below-the-line (BTL) marketing campaigns. Their efforts involve visiting plantations and rural districts to educate people, especially women, about mobile money and the importance of financial planning.

Through their free financial literacy training, Nationwide teaches locals about the benefits of using MFS and explains how to open a mobile money account. Thanks in part to this comprehensive training, 90% of MiCash accounts are active each month.

MiCash ambassadors also help spread the word. As Nationwide is particularly interested in supporting financial autonomy for women, they recruit female ambassadors from south of Papua New Guinea’s capital, Port Moresby. Ambassadors are active MiCash users who are brought to villages north of the capital to teach the locals all about the advantages of mobile money and how to start using it.

Operator wallets provide an alternative to cash transactions

Operator wallets, also called mobile wallets, are in-house apps run by Mobile Network Operators (MNOs) that enable phones to be used to store, send, or receive money. They provide a convenient and secure alternative to cash transactions. Millions of unbanked people are able to improve their financial situation thanks to services such as bill payment, savings accounts, and international money transfers.

Tigo Money serves the unbanked in Bolivia

Mobile penetration in Bolivia is 95%, but 60% of the population remains unbanked, making it an ideal area to introduce a mobile money service.

When Tigo Money launched in 2012, it offered cash-in, cash-out, person-to-person (P2P) transfers, as well as the ability to top up airtime minutes. Eventually, they added bill payment and ecommerce payment options as well. By June 2017, Tigo Money had reached 428,000 active users.

They’ve already spread to new areas. Tigo recently announced the launch of the KaiOS-powered Kitochi 4G smart in Tanzania, which will be sold for $21 USD and will provide access to Tigo Money services.

Orange Money drives economic growth in 17 countries

When Orange Money launched in 2008, it focused on money transfers and mobile phone top-ups. Now, Orange Money allows 40 million customers across 17 countries to make international money transfers, pay bills, and send and receive wage payments.

Before Orange Money, many families had to travel long distances to deliver cash to relatives. Now, families in several African countries can purchase Orange’s KaiOS-powered phones for $20 (3G) or $28 (4G) and then transfer funds with the touch of a button.

The ecommerce industry has benefitted as well. In the past, e-commerce businesses have struggled to make online sales because many Africans fear credit card fraud. However, Orange Money is now a trusted alternative to credit cards and has helped boost ecommerce throughout the continent. It has also begun offering loans and savings services to customers in Mali and Madagascar and has partnered with Canal+ TV to allow users to pay for TV subscriptions with Orange Money.

Mowali enables mobile money transfers across multiple providers

A partnership between MTN and Orange resulted in a versatile mobile money solution called Mowali, which is derived from “mobile wallet interoperability.” By making it possible to transfer money between different operators, Mowali essentially connects 338 million mobile money accounts across the African continent.

Interoperability allows users to make online and in-person purchases, regardless of the vendor’s mobile money operator. The objective of this impressive project is to promote the everyday use of mobile money for everything from person-to-person transfers to ecommerce.

Keep up with KaiOS

We are passionate about bridging the digital divide and allowing the next billion users to enjoy all the benefits of mobile connectivity. Follow us on Twitter to stay up to date with our work as we forge new partnerships, receive creative content from developers, and share stories of how mobile internet and smart feature phones can improve lives around the world.

Comments