Nigeria is one of the most exciting frontiers for emerging technology usage. The country, known as the “giant of Africa,” shows up in headlines calling it “Africa’s unofficial tech capital,” and “the new economy of Africa.”

However, many Nigerians fueling this rapid growth in the tech space actually under-utilize their technology. While these Nigerians show great interest in mobile devices and the internet, our research shows that they aren’t aware of the ways they can leverage technology to their advantage.

There’s a huge opportunity to help new users engage with technology and the internet in new ways, proving beneficial to both newly connected consumers and the key industry players that facilitate that connection.

We completed a study to better understand how the average Nigerian currently uses and perceives mobile phones and the internet. We hope our insights and recommendations will encourage you to become a part of Nigeria’s growing tech space.

Research overview

We surveyed 819 individuals and 48 retailers and phone sellers from seven Nigerian states. Overall, respondents were interested in owning a phone and having mobile internet, but were not fully aware of all the benefits and ways to use the internet.

We found that first-time internet users enjoy reading and surfing the web, but many have yet to discover how the internet can be beneficial to their entire community. New users tend to learn about the internet from members of their local communities in an offline setting, which often leads to a narrow view of what the internet has to offer. For example, they might only hear about a few specific apps and have misconceptions about both the internet and how to access it.

A large portion of respondents work informal jobs such as petty trading, farming, and artisan work. Although they spend most of their income on food, shelter, and clothing, they are still willing to invest in things that make their lives more fun and allow them to connect with others.

Who was included in our study?

We designed our study to provide an accurate depiction of newly connected consumers in Nigeria. As such, we structured our respondent pool to include specific age ranges, income levels, and geographic locations. Our interviewees can be segmented as follows:

- 40% rural, 35% semi-urban, and 25% urban: This split provides an accurate picture of Nigeria’s urbanization status.

- A significant portion works in informal and/or unstable jobs such as farming (15%), petty trading (31%), or artisan work (21%).

- All respondents earn less than NGN 360,000 (USD 990) annually.

- Our sample was slightly skewed toward a younger population because 54% of the entire Nigerian population is under 20 years of age. Ages 16-50 were included in the study.

Internet perception

Our study shows that respondents have a specific perception of internet content that is very different from that of the developed world. For example, using Opera, a major web browser app, is seen as synonymous with “browsing the internet.” This leads to the unintended consequence of users not discovering the browser app that comes with their mobile device if the app icon does not look similar to the Opera icon. We found a number of similar misconceptions of the internet and device capabilities throughout the study.

Finding: Internet is a status symbol, but not widely understood

The majority of the respondents claim they need an internet-enabled phone, but their reasoning is based more on social status and perception than the actual benefits.

“Well, this world right now is a global or internet world; everything is all about internet, so that is why everybody needs an internet-enabled device.” Male, 21-30 years, Anambra state, semi-urban

“In our time now, if you don’t have an internet-enabled mobile phone, it’s like you are nothing, and you must let people know you have it.” Female, 21-30 years, Abuja city, urban

From these responses (and others), we discovered that the need for internet access did not tie back to what respondents actually do online. Instead, their reasoning was based on how other people view them.

Recommendation: Market to communities, not individuals

New users need to be persuaded to adopt mobile internet and will turn to their social circle for guidance. To convince an individual, start with the community.

Urban residents tend to use the internet for a wider range of activities because they have more exposure to mobile internet through friends, family, school, and work.

Rural residents, on the other hand, do not have the same level of access, which means they have fewer real-world examples of how the internet can be used in their communities.

Both urban and rural first-time users generally look for ways to use the internet in a way that benefits the community as a whole.

To reach a wider audience, advertisers can focus on promoting the internet not to the individual, but to the entire community. For example, newly connected Nigerians are more likely to respond to a pitch that presents WhatsApp as a tool for organizing church gatherings and sharing study materials as opposed to an app for chatting with friends.

Finding: New users are unaware of how the internet can benefit them

Nigerians have heard good things about the internet, but have yet to discover how to take advantage of all the benefits.

As in most other markets around the world, we found that new users generally use phones for communication and entertainment. The most impactful uses—career development, personal health management, and business applications—are the least popular.

Nigerians in rural areas are even less likely to understand how mobile internet can benefit them personally. One rural interviewee said, “It doesn’t help my business. I farm, it’s just me, my hoe, and the farm…”

Recommendation: Educate users about how they can use the internet to their advantage

Mobile internet can provide support in areas like health, education, and business. However, these uses are the least popular because new users are unaware of their potential value.

Industry players can engage new users by clearly stating how they can gain practical advantages from mobile internet. Some examples:

- Promote your products to customers beyond your town by sharing photos on Facebook

- Are you a farmer looking to get a competitive advantage in the market? Use farming apps to access the latest crop prices.

- Do you live in an area where clean water is difficult to access? Use Google to search “how to kill bacteria in water at home.”

- Save $1-$2 a month by using WhatsApp instead of SMS to stay in touch with friends and relatives in other towns.

- Let your child learn English for free by watching educational videos on YouTube.

- Have you heard of Sudoku? It’s a free game that can train your logical thinking skills.

In Nigeria, as well as other emerging markets, new consumers responded best to visual marketing as opposed to text-heavy promotions. However, new users are reluctant to use data to play videos or download images, especially if they do not know how doing so will benefit them. Industry players should consider making onboarding content available without data charges. This small up-front investment is likely to pay off by converting text-only users to data consumers.

Finding: Nigerians fear misinformation and lack of privacy

For some Nigerians, negative perceptions of the internet have kept them offline. Many new users struggle to differentiate between truthful and false news sites, so they stay away from online news altogether. Financial scams, mainly through WhatsApp, are also a major concern.

First-time internet users are often unaware of privacy settings, so they fear that having a phone will allow them to be tracked and easily found. This is especially dangerous for women, who worry that online harassers will be able to discover their location.

Recommendation: Help customers filter content and configure privacy settings

Mobile carriers and shop owners can start at the source by helping customers set up privacy settings before they leave the store. Showing users how to block unwanted messages and remove explicit content from their social feeds helps them feel safer online.

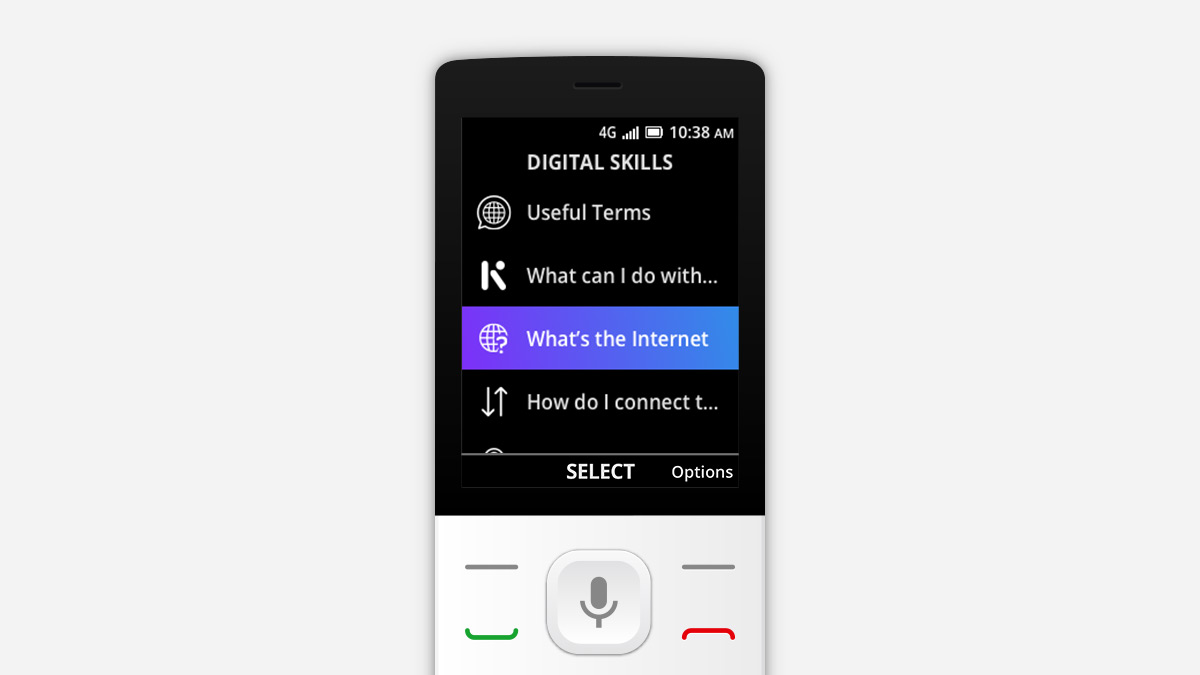

By promoting educational resources such as Free Basics or the Life app by KaiOS, industry players can combat negative views of the internet. It’s also important to design—or encourage others to design—user-friendly products for consumers with lower digital literacy levels. For example, limiting the use of technology jargon while prioritizing visual content over text can make devices more accessible for new users. Features such as simplified websites, content in local languages, and easy-to-use menus allow new users to feel more confident using mobile phones.

Purchasing devices and data

Overall, participants responded positively to the idea of buying their first internet-enabled phone or replacing existing mobile phones with superior models. Where and how they purchase devices, however, depended heavily on their sometimes inaccurate perceptions of security, the availability of warranties, and the affordability of the device.

Finding: Nigerians prefer to pay in cash and make purchases at phone shops

Mistrust in online payment systems, fear of fraud, and difficulty setting up payment plans result in 80% of respondents using cash to purchase phones. Mobile money usage in Nigeria has increased in recent years, but for big-ticket items like phones, people stick with cash because it’s the most familiar method.

Nigerians purchase devices through three main avenues: phone shops, authorized dealer shops, and open markets.

Our study shows that phone shops were the preferred avenue because respondents believed phone shops offered original phones (as opposed to knock-offs sometimes sold in markets), more choices, competitive prices, and warranties.

“People now prefer going to stores where you get exactly what you want, you know that these people are not scamming you, this is a company, you know that this is their branch, so whatever happens to your phone at the time of guarantee you can always come back and complain and they will now follow up.”

Authorized dealers suffer the incorrect perceptions that they offer fewer options and no warranties. Open markets are the least trusted due to the perceived risk of fake phones.

Recommendation: Advertise the availability of warranties and original devices

Nigerians often incorrectly assume only manufacturers can offer original devices and warranties. To encourage purchases through other avenues, mobile shops and carriers should leverage visual ads that show off a variety of phone options and clearly display warranty offers.

Accountability is key. Retail staff should be trained to fully explain warranties and the types of follow-up services the shop offers. When new users know that they can come back to the seller with any issues or questions, they are more likely to make a purchase.

Finding: New users tend to buy small data packages even if the cost per MB is higher

New users often have low and/or unstable income, so they rely on friends and family to purchase phones and data bundles for them. These purchases are either given as gifts or meant to be repaid with money or bartering.

Phones and data are also sometimes seen as communal. It’s not uncommon for families to share devices or for people to borrow phones to check social media or get online.

Regardless of who pays for the data, Nigerians generally prefer to buy smaller data bundles, despite the higher cost per MB. First-time users often have a limited understanding of how data packages are priced and how data is consumed, so they struggle to maintain consistent data usage.

As a result, small data packages are purchased early in the month and quickly depleted. As many new consumers live paycheck to paycheck and do not yet recognize the internet as a necessity, replenishing data is not a priority.

This may also be why Nigerians use the internet “on demand,” meaning they do not let apps run in the background or keep data turned on when they are not actively using the internet.

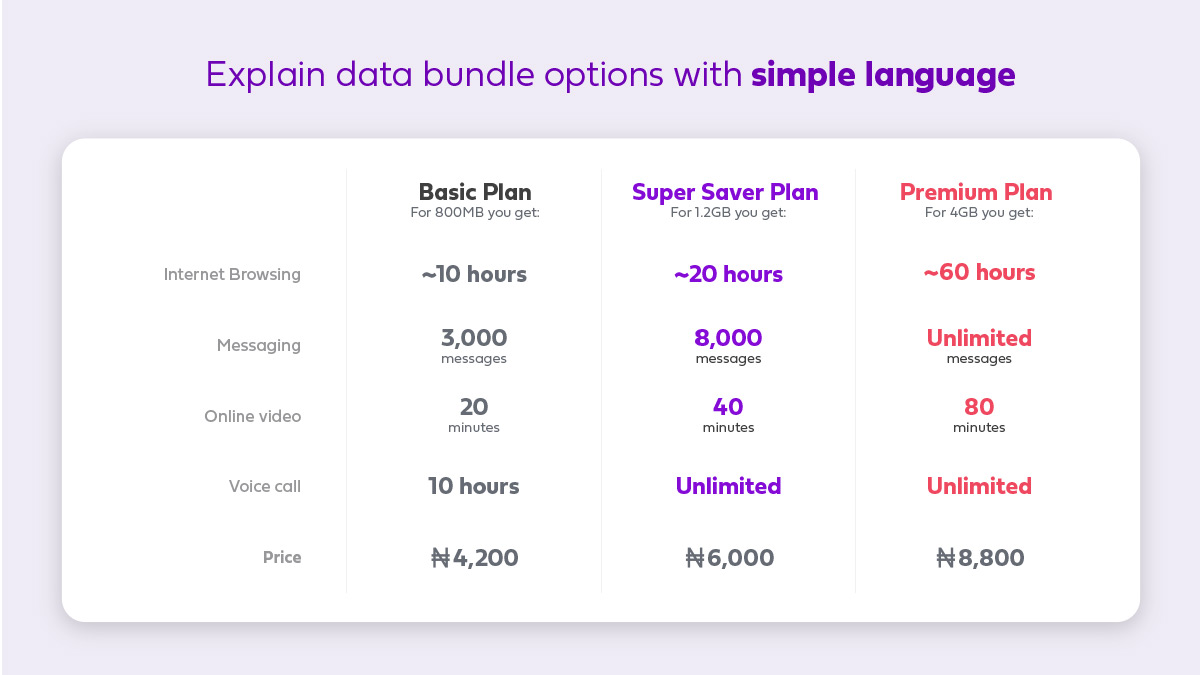

Recommendation: Use simpler language and clearly explain bundle options

First-time internet users prefer simple explanations of what they are paying for. Carriers that introduce more creative pricing models that appeal to these new consumers will have more success in selling data packages.

For example, offering pricing based on time or a specific service rather than volume (MB/GB) makes the internet seem more accessible and user-friendly. Nigerians may be more willing to buy data in forms such as one hour of unlimited browsing per day or unlimited WhatsApp usage for a flat rate. Globe Telecom had great success with this strategy – its data service revenue went up 17% two years after introducing data-free YouTube videos.

Industry players should also consider leveraging free data to build data usage habits. Telecommunications company, MTN, uses this tactic by surprising users with free bonus data. Not only do these freebies generate excitement, they encourage users to explore the internet without the fear of overspending.

Providing free data promotions along with pricing transparency is a great way to build trust in new markets. New users worry about their data consumption and how much it will cost them, so services such as daily spend limits or warnings when data is running out will be well-received.

Internet and device usage

Limited experience with the internet often results in a narrow view of all it has to offer. We found that both urban and rural respondents who claimed to use the internet regularly still stuck to very basic online activities.

New users learn from their social circle, which leads to a limited view of the internet

While 82% of respondents claimed to have experience using an internet-enabled phone, only 32% mentioned surfing the internet or using instant messaging apps as one of their top three phone uses. This suggests that internet usage is not yet a core daily activity in Nigerian households.

Experienced internet users in developed markets are quick to Google how to do something, but new users turn to people they know personally and feel they can trust. Unfortunately, this means new users only learn what their communities can teach them.

Lack of knowledge causes Nigerians to use their internet-enabled phones in a limited way. Without exposure to activities like downloading apps, setting up online accounts, using web browsers, or making video calls, new users never learn all the internet has to offer them.

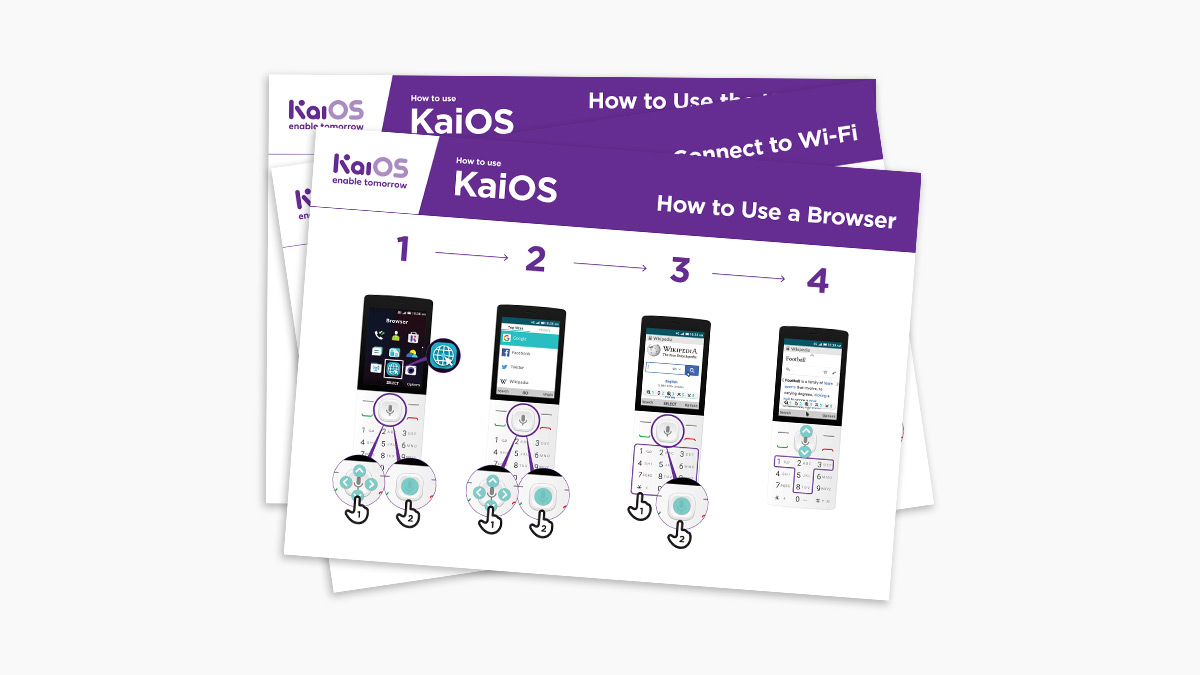

Improve digital literacy with welcome packs and in-store training

New users need ways to build their digital skills and expand their understanding of their phones and mobile internet. Creating “welcome packs” that include bite-sized content such as video guides and walk-throughs can enable consumers to learn, both before and after they make a purchase.

Digital skills welcome packs should come pre-loaded on consumer phones and be available on demo devices in-store. Pre-loaded video content appeals both to users with low literacy levels and to the data-conscious who may hesitate to use their data to look up guides.

Retail staff play an important role as well. Staff should be trained and incentivized to teach new users the basic capabilities of internet-enabled phones and the internet in general. When members of the community become well-trained employees, they can become a trusted source for all tech-related questions and issues.

While educating customers may lengthen the sales process, the time investment will pay off. When new customers have a better understanding of what mobile internet can do, they will use more data.

Internet access challenges

Limited network coverage and access to electricity are serious concerns for Nigerian consumers.

Nigerians practice “SIM Swapping” to work around poor network coverage

Many Nigerians have multiple SIM cards and practice “SIM swapping.” Switching out SIM cards allows users to access different networks so they can shop around for the best coverage. It also helps them take advantage of limited-time promotions from various carriers.

Increase network coverage and stability

If mobile carriers invest in increasing network coverage and migrating 2G connections to 3G and 4G, they can gain a loyal customer base.

Reliable 3G and 4G coverage would prevent SIM swapping and keep users on the preferred network. Mobile carriers with a reputation for great network stability and coverage can benefit from higher revenue generated from voice and data usage as well.

Only 54% of the Nigerian population has electricity in the home

Battery life is a significant concern and charging phones can be an issue. Some users own multiple devices so they can switch phones when one runs out of battery power. Similarly, smartphone owners often use basic phones for calls and texts so they can preserve their smartphone battery for internet access.

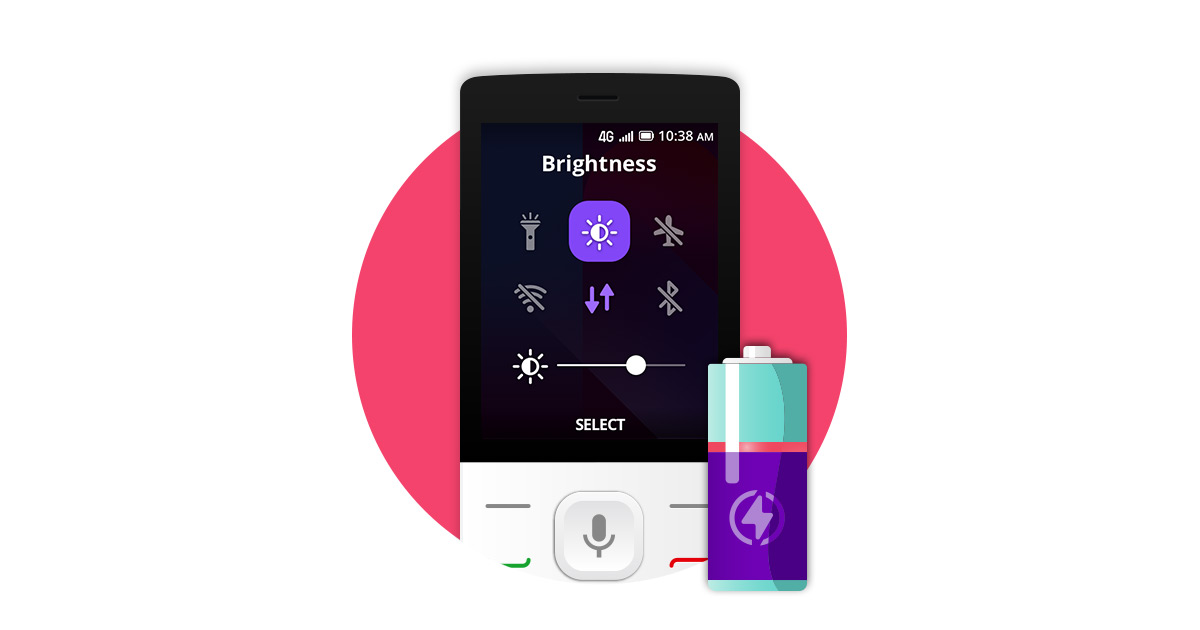

Teach consumers about battery life and power-saving options

In Nigeria, long battery life should be prioritized as a key selling point. Many new consumers could be persuaded to purchase a smart feature phone if they knew certain models boast a battery life of several days, whereas smartphone batteries hardly make it to the end of the day.

Mobile carriers and shops should also educate new users about power-saving tips like adjusting screen brightness, and introduce them to power banks that can be used as backup power sources.

Bring internet to the “giant of Africa”

Nigeria is poised for increased mobile connectivity, but much work is still needed in user education to ensure people make the most of their internet access.

We will use this research to further improve our own products for first-time internet users in Nigeria, and hope it will be beneficial to you and others as well. We will also continue to conduct similar research in Nigeria and other countries and will share our findings here on the KaiOS blog.

Special thanks to Afriscaper (link: https://afriscaper.com/) for helping us carrying out the survey part of the research projects, and providing localized expertise in the Nigerian market.

Thanks for great info keep sharing updates

I live in Kafanchan, Kaduna State. Which is your nearest retail outlet, please? I’d like to recommend KaiOS to students in our digital literacy class

Hi there! As we are not selling devices on our own, we recommend checking the device distribution info on the manufacturer’s website, and then checking if there’s a device in your area.

There are a number of internet users in Nigeria with Android phones who don’t know that they can open up Google Chrome and search for information.

They would call me up asking me for things like their bank’s customer service number or shop opening times.

Phone shops and mobile phone operators can play a part by giving out visual leaflets in their shops showing people how to do the basic things online.